Non-current assets are also termed fixed assets long-term assets or hard assets. Presentation of Supplies on Hand.

Office Supplies Are They An Asset Or An Expense The Blueprint

All of these items are 100 consumable meaning that theyre purchased to be used.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Current_and_Noncurrent_Assets_Differ_Oct_2020-01-e74218e547134e3db0ac9e9a7446d577.jpg)

. Office Supplies With ongoing industry consolidation and the migration of sales to direct channels the office supply sector is one of the most challenged within the retail industry. They apply to field offices only. When supplies are purchased the amount will be.

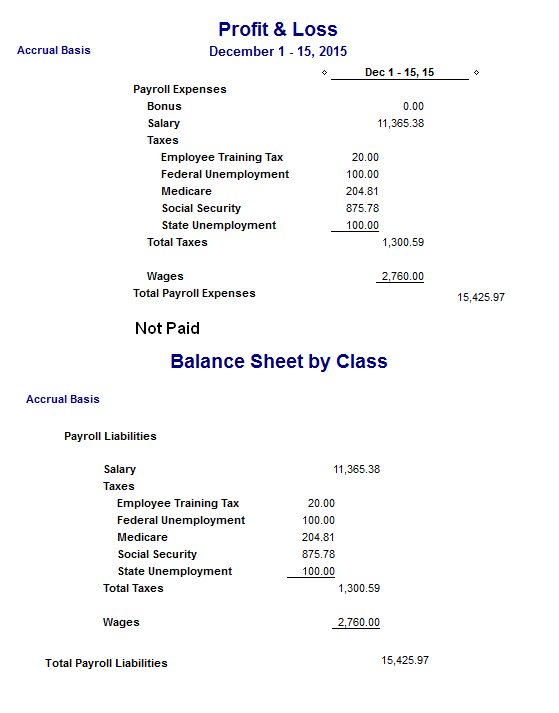

Specific sections on office supplies stationery flags and insignia and furniture provide guidance on the use and management of these categories of items. For supplies that are left unutilized at the end of the year they are supposed to be treated as Current Assets at the end of the year because the company has already paid for these supplies in advance but is yet to extract the utility from these particular. Once the supplies are used they are automatically converted to expense which is a more reasonable step to take.

Usually businesses account for supplies as expenses. Non-current assets are assets that cannot be easily and readily converted into cash and cash equivalents. Answer 1 of 9.

Having worked with some of the sectors largest retailers on their most challenging projects we have developed a vast experience base to offer our clients. In simple words supplies are assets until they are used. Office Supplies Consumed are categorized as an expense.

Supplies left unused at the End of the Year. Examples of non-current or fixed assets include. Technically speaking unused office supplies are an asset and to the extent that they are expected to be used within a year they are considered to be a current asset.

Examples of Factory Supplies. For those reasons office supplies are a current asset. A Office Supplies 800 To record office supplies used.

The equipment here means tables chairs computers etc. Supplies can be considered a. The cost of office supplies on hand at the end of an accounting period should be the balance in a current asset account such as Supplies or Supplies on Hand.

Office supplies are items that a business uses in routine tasks. Once supplies are used they are converted to an expense. If any office supplies expenses or equipment cost over 2500 these become depreciable assets and you must depreciate these assets spread the cost out over time.

The accounting treatment for them will also differ. When they are used they become an expense. Your office expenses can be separated into two groups - office supplies and office expenses.

Office equipment is the asset purchased by the organization which is used while working for the company. The third large office equipment or furniture should each be classified as a fixed asset to be depreciated over time. This is because their cost is so low that it is not worth expending the effort to track them as an asset for a prolonged period of time.

Examples of Office Supplies. A current asset representing the cost of supplies on hand at a point in time. Pens and pencils.

You can only deduct the cost of supplies you use in the current year so dont stock up near the end of the year. The cost of the office supplies used up during the accounting period should be recorded in the income statement account Supplies Expense. A business can categorize office supplies expenses and equipment accordingly.

31 Supplies Expense 800 Adj. Its important to correctly classify your office expenses supplies and equipment to make things easier for tax time. What makes up current assets on a balance sheet.

The simplest and most intuitive way to view this is to think about your own net worth. Office supplies include Office Corporate Stationery are considered a current asset until the point at which they are used. Depreciation for the month 150.

Office supplies are generally categorized as expenses because they do not produce revenue. How to Classify Office Supplies on Financial Statements. The utilized office supplies are expenses in the Profit and Loss Account of the company.

November 04 2021 Supplies are usually charged to expense when they are acquired. As a business uses its property plant and equipment an adjusting entry is required to allocate the assets cost. Office supplies are the kind of things that are utilized on a regular basis like stationary simple office accessories etc.

Technically if you purchase any items such as the items below you should be categorizing them as an asset. Office Equipment and Office Supplies. Office supplies expenses include items such as staples paper ink pen and pencils paper clips binders file folders and markers.

Fixed or Non-Current Assets. Would you consider the food in your cabinet an asset. The Supplies on Hand asset account is classified within current assets since supplies are expected to be consumed within one year.

Is it true office supplies are a current asset. If the decision is made to track supplies as an asset then they are usually classified as a current asset. Heres a list of office supplies many businesses routinely purchase.

Office supplies will also provide future economic benefits and their cost can be measured reliably. At the end of the period the. While they are an asset because they hold value they are not recorded as an asset but are recorded as an expense.

In general supplies are considered a current asset until the point at which theyre used. Office supplies are considered current assets which means they need to be replenished often usually but not always within a business year. Yes they are controlled by an entity or a company.

The adjusting entry records the cost allocation to an expense account called Depreciation Expense. Office supplies and furniture necessary to create a productive working environment in field offices. Office desks office chairs computers printers fax machines This allows you to depreciate them and thus deduct them on your business tax return.

However a business can also record them as assets. Beside above what account is supplies.

Are Office Supplies A Current Asset Finance Strategists

Chapter 9 2 Double Entry Accounting Accounting Debits Credits

Office Expenses Vs Supplies What S The Difference Quill Com Blog

:max_bytes(150000):strip_icc()/dotdash_Final_How_Current_and_Noncurrent_Assets_Differ_Oct_2020-01-e74218e547134e3db0ac9e9a7446d577.jpg)

Current Noncurrent Assets Differences Explained

Office Expenses Vs Supplies What S The Difference Quill Com Blog

Stationery Is An Asset Or An Expense Online Accounting

Are Office Supplies Categorised As Assets Or Expenses Youtube

0 comments

Post a Comment